Building a pair of AI glasses isn’t actually that hard as long as you’re in China.

In the Pearl River Delta, as long as there’s an order, AI glasses can be prototyped in three days and go into production in seven days.

In the Yangtze River Delta, the world’s most advanced optical waveguide and Micro LED display technologies are all gathered here—even Silicon Valley giants can’t help but praise it as “truly impressive.”

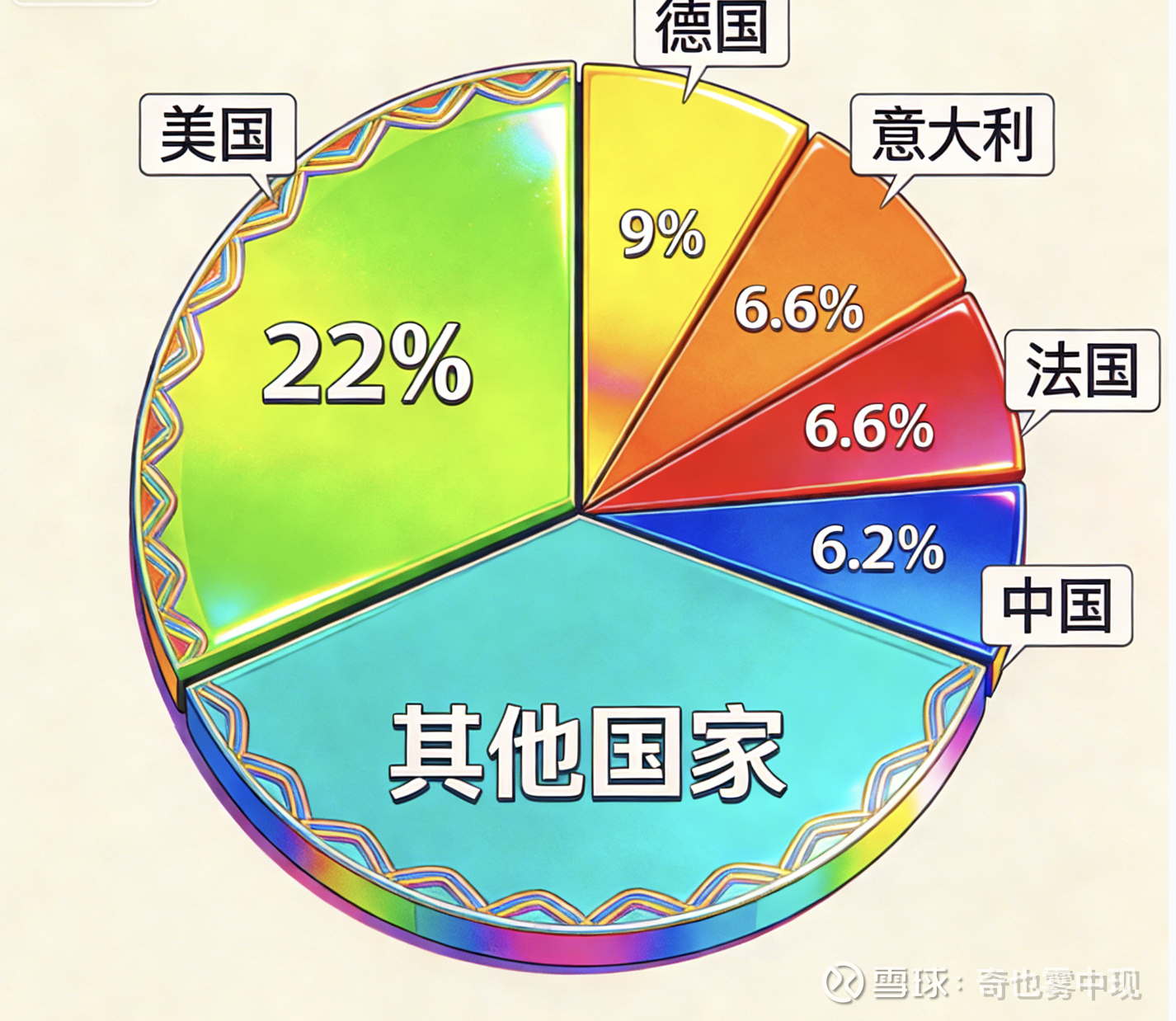

A report from Bank of America Securities (BoFA) reveals even more astonishing data:

Over 80% of companies in the global AI glasses supply chain are based in China.

AI glasses, a smart device regarded by Silicon Valley as the next-generation computing gateway, are now firmly in the hands of Chinese factories.

China’s mastery over AI glasses is comprehensive. In key areas such as camera modules, optical coating, structural components, and full device assembly, Chinese companies are both leaders and trendsetters. Meng Xiangfeng, CEO of Zhige Technology—one of the core component companies—once emphasized:

“You don’t even need to leave the Yangtze River Delta to source and test all the core components for AI glasses.”

An AI glasses device consists of numerous components, but the two most critical and technically challenging parts are the chips and the optical modules (which include the optical engine, waveguide, and display). China’s dominance in the global AI glasses industry is largely due to breakthroughs and market advantages in these areas.

The chip is essentially the "brain" of AI glasses, responsible for processing and computation;

The optical module serves as the "eyes" of AI glasses, responsible for the optical display of the lenses;

These are also the most "expensive" components. The optical module accounts for over 40% of the total cost of AI glasses, while the chip makes up more than 30%. Together, they consume more than 70% of the total cost, making them the core value drivers of the industry.

In the field of optical modules, "waveguide technology" is the core technical barrier—and in this area, China has already achieved global leadership.

In Huzhou, the capital of southeastern China's Zhejiang province, startup Zige Technology, which originated from the Department of Precision Instruments at Tsinghua University, has not only overcome the "rainbow effect" issue that has plagued the global AI glasses industry, but has also managed to make diffractive waveguide lenses weighing less than 4 grams—about the weight of a spoonful of salt.

Meanwhile, JBD (Shanghai Jade Bird Display) has developed a Micro LED optical engine for AI glasses with a volume of just 0.15 cubic centimeters and power consumption 40% lower than the industry average.

Beyond the optical battlefield, Chinese companies are also excelling in the chip sector.

Zhuhai Hengxuan Technology’s AI glasses chip has become one of the core suppliers for Meta Ray-Ban; Fuzhou Rockchip’s AI glasses chip provides the "computing brain" with 10 TOPS for the Xiaomi AI Glasses, which sold out immediately upon launch. Companies like Allwinner Technology and Xincheng Technology are stirring up a storm of cost-effectiveness in the mid- and low-end markets.

The strength of China’s industry is also reflected in the completeness of the supply chain and the depth of vertical integration.

Beyond components, in the precision manufacturing sector, giants such as Goertek, Luxshare Precision, and Lens Technology have brought all their lean manufacturing experience from the smartphone era into the AI glasses industry.

For example, Lens Technology has reduced the weight of AI glasses to 49 grams and controlled assembly tolerances to the point where they are almost invisible to the naked eye—on the production line, more than 20 processes are precisely linked, power consumption curves are repeatedly calibrated, and even the nose pads have gone through more than 10 iterations.

According to data from the Huaqiangbei market in Shenzhen, in 2025, Huaqiangbei alone sold AI glasses to more than 50 countries and regions worldwide, with average monthly sales exceeding 100,000 units and an export ratio of nearly 40%, and its global market share continues to rise.

Today, the world’s leading AI glasses brand, Meta, once had its product dismantled by foreign media, only to find that its packaging prominently displayed the “GTK” label—originating from GoerTek, a Chinese company.

“Meta has no choice but to work with them (Chinese factories), because they are the most stable and reliable suppliers of key components,” according to Financial Times.

Google, the first to propose the concept of smart glasses, recently announced a partnership with Chinese company XREAL to jointly develop the next generation of AR glasses, relying heavily on “Made in China”.

From OEM to Innovation

In a media interview, XREAL founder Xu Chi once said: “There’s a consensus in the AI glasses industry: if you want to bring costs down, you ultimately have to manufacture in Asia, and China is definitely the best choice.”

The reason China is the best choice is not just low cost, but more importantly, its rapid technological innovation and leading manufacturing capabilities.

After more than a decade of development, China’s AI glasses industry chain has transformed “from OEM to innovation, from following to leading.”

China was not the first mover in the AI glasses race. As early as 2012, Google launched the once-famous Google Glass, which could take photos, make video calls, and reply to emails. Priced at a staggering $1,500, it was the epitome of “future technology.” Two years later, in 2014, Mark Zuckerberg spent $2 billion to acquire Oculus, instantly igniting the VR glasses craze. For several years, the world was abuzz with talk of VR. Microsoft chose a B2B path. In 2015, Microsoft’s first-generation HoloLens AR glasses debuted at a hefty $3,000, targeting enterprise customers—sold to KFC for training fry cooks, to NASA for astronaut training, and to Mercedes-Benz for remote machinery repairs, and so on.

By the way, here’s a quick explanation of the differences between VR, AR, and AI glasses.

The defining feature of VR headsets is their enclosed optical system, which isolates users from reality and immerses them in a fully virtual world (Virtual Reality). When you put on a VR headset—whether you're riding a virtual roller coaster, watching a horror movie, or attending a concert—the core experience is all about being "right there in the moment," delivering the highest level of immersion. However, the trade-off with VR is that it cuts you off from the real world, which limits its practical applications.

AR glasses stand for Augmented Reality, which essentially adds a "digital filter" to the real world in front of your eyes. Using technologies like waveguides and Micro LED, AR glasses overlay virtual information onto real-life scenes. For example, as mentioned earlier, when a technician wears Microsoft’s AR glasses during training, the screen in front of them displays the names of parts and installation steps, guiding them through each process.

AI glasses are a product of the recent boom in AI large models. Their display principles are similar to AR glasses, but with the added power of artificial intelligence models, AI glasses can handle a wide range of high-demand scenarios such as real-time translation, real-time navigation, and instant conversations with AI assistants, truly making AI glasses "useful and user-friendly" in everyday life.

But all of this came later. In the early days of industry development from 2012 to 2015, Silicon Valley giants were burning cash to find their way, while Chinese factories could only scrape by, earning less than 5% in contract manufacturing fees and having virtually no say in the industry.

But Chinese factories never "accept their fate." In 2015, the "Made in China 2025" initiative was launched, ushering in a wave of policy support for hard tech.

Established companies like Goertek, Crystal-Optech, and Sunny Optical started to "learn by doing," gradually getting involved in product design and even proactively proposing optimization solutions.

At the same time, Chinese companies began expanding globally.

In 2016, Crystal-Optech acquired Israeli AR company Lumus to boost its R&D capabilities; in 2017, Goertek invested in US micro-display technology company Kopin, laying the groundwork for its optical strategy…

During this period, a series of US "chokehold" policies only served to "force" a new wave of top-tier Chinese startups to emerge.

For example, in 2015, Shanghai JBD Display Technology (JBD), mentioned above, was established. Its core MicroLED micro-display technology has gradually achieved global leadership in key metrics such as brightness, power consumption, and mass production.

In 2019, Beijing ZG Technology was founded, focusing on AR diffractive waveguides and micro-nano optics. It possesses fully independent and controllable full-stack core technologies in this field, breaking the overseas monopoly on waveguide technology.

From chips to screens, from optical modules to precision manufacturing, one technological high ground after another has been conquered, with the banner of "Created in China" proudly planted.

From contract manufacturing, to following, to innovation, and now leading, the AI glasses industry chain has become another "world-class trump card" for China in emerging industries.

Taking Center Stage

In sync with the industry chain, Chinese AI glasses brands are experiencing explosive growth.

More than 80% of supply chain companies are concentrated in China, and large-scale production has rapidly driven down the prices of core components. AI glasses that once sold for over 10,000 yuan are now priced as low as 1,999 yuan.

At the same time, the clustering effect of the industry chain has accelerated the R&D pace of Chinese companies. Whether in technology iteration or product updates, they are leaving overseas competitors far behind.

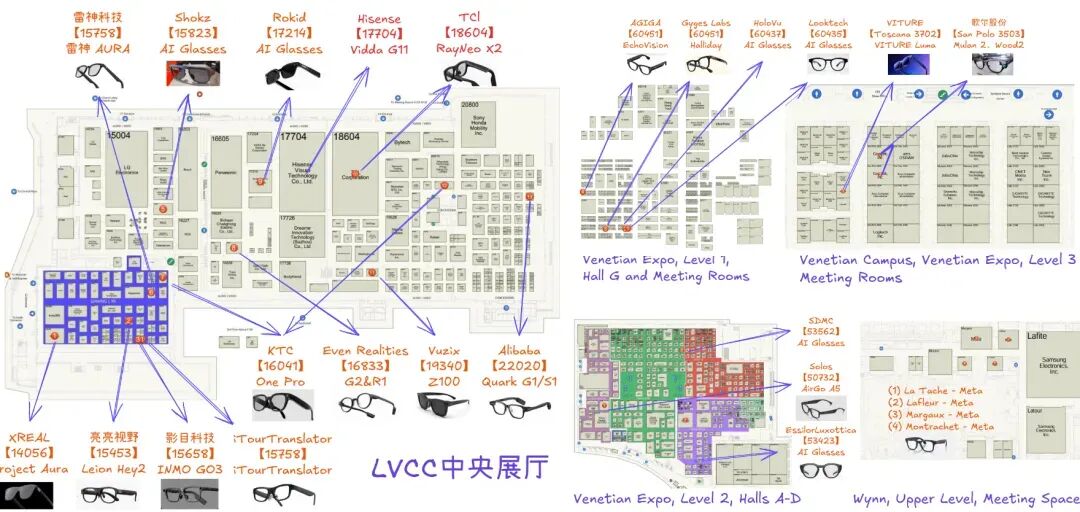

This January, the CES tech show in Las Vegas became a stage for Chinese AI glasses.

Backed by TCL, Thunderbird Innovation launched the world’s first consumer-grade AI glasses supporting eSIM functionality, featuring a 43-inch 3D floating giant screen that shattered people’s imaginations.

XREAL unveiled the flagship professional gaming glasses ROG XREAL R1, co-developed with ASUS ROG, becoming the industry’s first Micro-OLED AI glasses with an ultra-high 240Hz refresh rate.

Rokid began exploring the cutting edge with its "screenless" AI smart glasses Style, weighing only 38.5 grams, striking a balance between extreme lightness, an open AI ecosystem, and practical functionality.

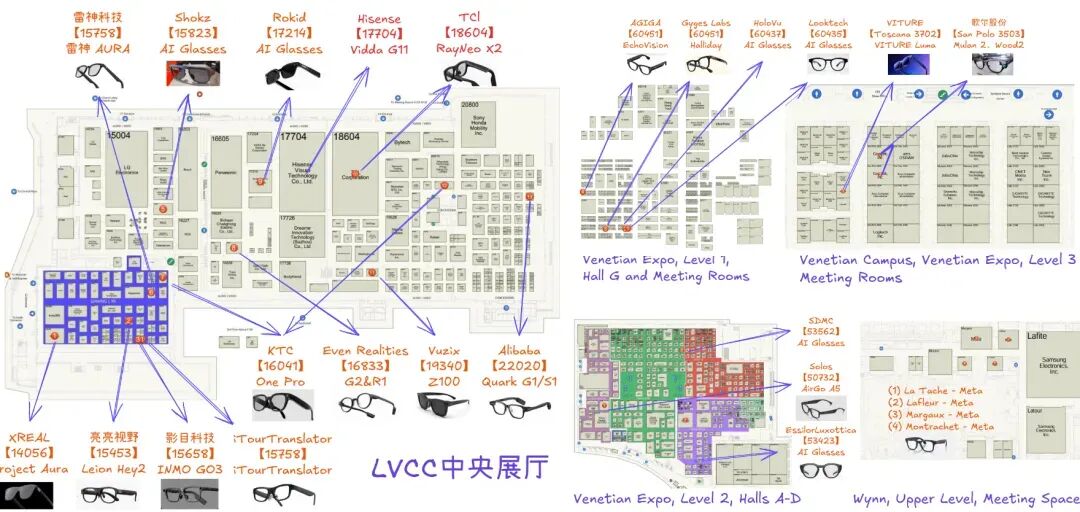

There are also Quark, INMO, Shokz, LLVision, and more... Among AI glasses exhibitors from around the world, Chinese companies accounted for nearly half, representing an overwhelming advantage.

▲CES2026 AI glasses brand booth distribution Source: Lang Hanwei@AIWatch.ai

Even earlier, tech giants such as Huawei, Xiaomi, and Baidu (Xiaodu) frequently launched and sold out their AI glasses, while cross-industry players like Li Auto also entered the fray, releasing its Livis AI glasses in December last year, focusing on the integration of in-car and wearable glasses.

Chinese AI glasses have long taken center stage on the international scene.

According to IDC data, in the first half of 2025, global shipments of smart glasses reached 4.065 million units, a year-on-year increase of 64.2%—with Chinese smart glasses manufacturers shipping over one million units.

IDC further predicts that 2026 will mark a turning point for large-scale development in China’s smart glasses market. Over the next five years, the compound annual growth rate in China is expected to reach a staggering 55.6%, ranking first in the world.

The explosive growth of China’s AI glasses industry is driven by the ultimate synergy of the supply chain, continuous breakthroughs in core upstream technologies, the support of China’s comprehensive industrial system, and—above all—the rapid iteration of all these elements. It is the relentless spirit of Chinese factories—never giving up, never backing down—that has conquered one challenge after another, ultimately building a complete system, a strategic advantage, and opening up new horizons, establishing yet another trump card for Chinese technology:

更多精彩内容,关注钛媒体微信号(ID:taimeiti),或者下载钛媒体App